25 Debt Collection Statistics: A Must-Know in 2024

Debt collection affects a large proportion of the population and is an important part of the financial industry.

But just how widespread is debt collection and what insights do the numbers provide?

With that in mind, we’ll cover key debt collection statistics that reveal debt collection’s extent and impact.

Debt Collection Statistics: Key Numbers

- Over 70 million adults in America have had their debts turned over to a debt collector.

- U.S. household debt reached nearly $17.3 trillion in 2024.

- There are 6,431 debt collection agencies in the U.S. in 2023.

- The average success rate for debt collection agencies is around 20-25%.

- About 40% of consumers report being contacted by debt collectors four or more times per week.

- 98% of third-party debt collection agencies mailed letters to debtors.

- 57% of consumer credit report collections tradelines were medical debt, the most common type shown.

- Debt collection accounts for 27% of all complaints submitted to the CFPB, the highest among all categories.

Source: Federal Reserve Bank of New York, Collection Bureau of America, MicroBilt Corporation, Consumer Financial Protection Bureau Survey, Statista)

Debt Collection Agencies

Debt collection agencies in the U.S. are experiencing a decline in numbers and shifts in revenue sources. Here’s a look at the current state of the industry according to recent data:

- As of 2023, there are 6,431 debt collection agencies in the U.S, a 2.1% decrease from 2022.

- 37% of the total revenue collected by collection agencies came from the financial services industry.

- Between 2018 and 2023, the number of these businesses declined by an average of 2.1% per year.

- New York (725 businesses), California (706), and Texas (525) have the highest numbers of debt collection agencies in the U.S.

Source: Statista, Ibisworld

Consumer vs. Debt Collection Agency Experience Statistics

Consumers often face persistent and harsh tactics from debt collectors, which negatively affect their experience. Here’s what the latest study reveals:

- 37% of consumers reported that debt collectors attempted to contact them four or more times per week.

- 17% of consumers said debt collectors tried contacting them eight or more times per week.

- Over 25% of consumers report receiving threatening calls from debt collectors.

- 53% of consumers contacted about debt last year said at least one collection attempt was wrong.

- Over 36% of consumers report being contacted at inconvenient times.

- 15% of consumers contacted about a debt in collection within the previous year reported being sued.

Source: CFPB Survey

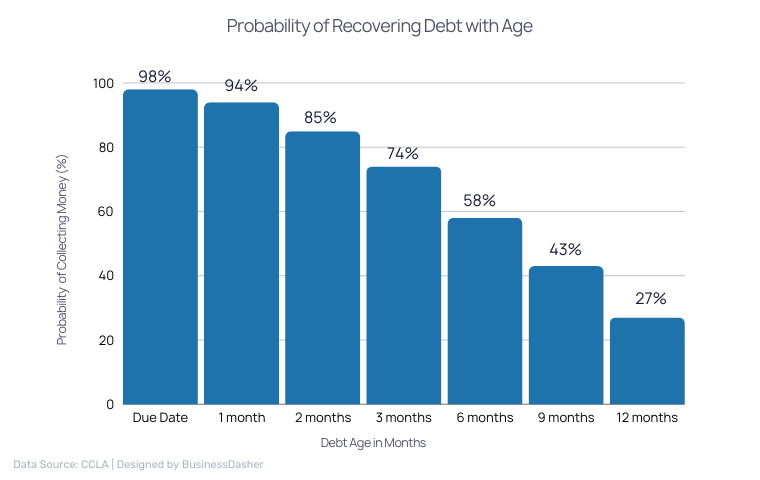

Probability of Recovering Debt with Age

Debt recovery rates are declining as debt ages, according to CCLA. Here’s a look at the recovery probability over different periods:

| Debt Age | Probability of Collecting Money (%) |

| Due Date | 98 |

| 1 month | 94 |

| 2 months | 85 |

| 3 months | 74 |

| 6 months | 58 |

| 9 months | 43 |

| 12 months | 27 |

Source: CCLA